Hey, Joe Six Pack here, JS for short. I wanted to invite you to my investment cooler.

This will be a blog about how an average Joe (Person) would invest in the stock market, his ideas and philosophy, and how he would invest to contend with the institutional Goliaths’ who rule the financial markets.

Tip of the Month:

The markets move on fear and greed.

For example, Merck & Co. (MRK) is one of the world’s leading pharmaceutical companies, with a market cap of $250.64 billion. Merck Ranked No. 1 in the Pharmaceutical Industry Among Barron’s 100 Most Sustainable U.S. Companies 2023. With the end of COVID-19 and the announcement of the RFK Jr. Department of Health and Human Services secretary since 7-29-24, the stock has dropped from $127.78 to a 52-week low of 94.48. The fundaments have not changed. Joe invested $500 into the stock and purchased 5.07 shares at $98.68 on 12/30/24.

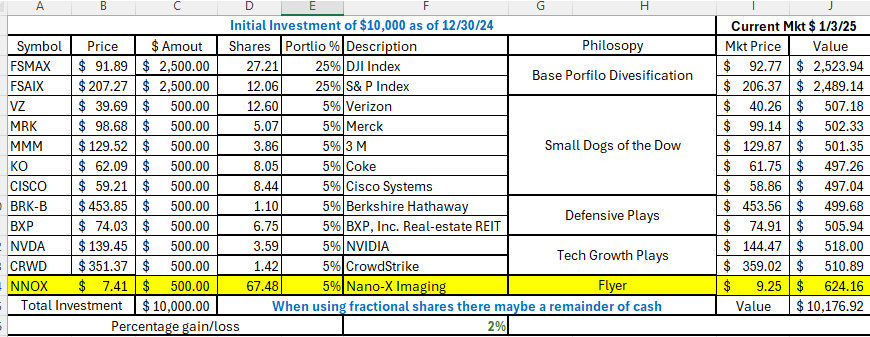

The initial investment:

We are going to start off with a mock portfolio of $10,000. I feel this is a fair amount that an average Joe could accumulate. Although you can start with any dollar amount, you should not be investing in the stock market if you do not have at least that amount, which you can risk or do not need for the next 5 years. Buying individual stocks is risky and should be considered a long-term wealth-building strategy. Please visit this link to get a full disclaimer: www.Joe6PC.com/disclaimer.

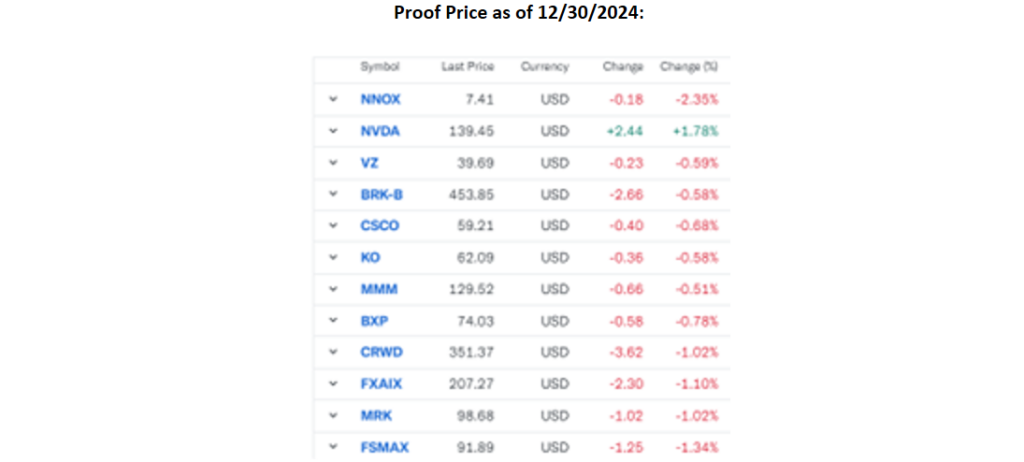

I will take screenshots of what I am investing in and my moves. This is a monthly blog, but there could be an investment change at any time when I see a way to take advantage of the institution’s moving money. Anyone who joins the blog will get an email with any of my moves within 72 hrs.

Please excuse the graininess of all the illustrations. This is time-sensitive information so I needed to publish before the markets change. I will be working to make them better.

Now that we have our account set, let’s do some investing. Don’t worry about the cost per share. We are going to buy fractional shares. Us Joe’s work in percentages.

I will show what I am buying or selling and how many shares each, along with a short explanation. If I were to explain all the reasoning behind each stock, this blog could go on forever.

Make sure to do your own due diligence to understand each investment and its risk and rewards.

Always Know What You Own.

Joe Six Pack’s initial invents:

Two market index funds, FXAIX (S & P 500) and FSMAX (DJI) – this is the majority of the Portfolio to build a strong base.

Large-cap stocks, where I am following the Small Dogs of the Dow, which returned 12.6% to investors in the last 20 years. https://www.briefing.com/the-big-picture/archive/2024/12/20/a-2025-dogs-of-the-dow-preview

NVDA & CRWD diversification into the tech industry

BRK-B & BXP defensive play against market downturns

The real flyer is NNOX, An Israel-based Medical AI company. {This one could go to 0 or double (?)}

If you join the Blog, I will share this spreadsheet with you so that you can update it as things change.

NNOX took off before I could get this published. I still think it’s a good buy under $10.00 a share.

Proof Price as of 12/30/2024:

If you want to follow these investments to see how they track in real-time, create an account and a Watchlist with Yahoo Finance. This is where I take my screenshots from.

As always, investing in stocks is a risky business.

This is how we make our money grow.

I am also taking a risk by publishing my thoughts and ideas.

Carpe diem.